1. Automobile insurance refers to a kind of commercial insurance that is liable for personal injury or property loss caused by natural disasters or accidents of motor vehicles.

2. Hello, vehicle insurance, that is, motor vehicle insurance, abbreviated as car insurance, also known as car insurance. It refers to a kind of commercial insurance that is liable for personal injury or property loss caused by natural disasters or accidents of motor vehicles.

3. Automobile insurance, abbreviated as car insurance, refers to the protection of casualties and property losses caused by natural disasters or accidents of motor vehicles. Car insurance is a kind of property insurance, which arises and develops with the emergence and popularization of automobiles.

1. Car insurance mainly includes: traffic enforcement insurance, third-party liability insurance, vehicle loss insurance, vehicle personnel liability insurance, theft and robbery insurance, separate glass breakage insurance, and traffic enforcement insurance is a must-buy.

2. The types of automobile insurance mainly include the following types: traffic enforcement insurance, vehicle loss insurance, third-party liability insurance, whole vehicle theft and robbery insurance, separate glass breakage insurance, spontaneous combustion loss insurance, non-deductible special insurance, etc.

3. You can buy three types of car insurance: traffic insurance, three-party insurance and car damage insurance. The following is a specific introduction to car insurance: Traffic enforcement insurance: Traffic enforcement insurance is the insurance that every car owner must buy according to law. When a vehicle has a traffic accident, it can have the most basic insurance claims.

4. Vehicle insurance generally requires traffic insurance, vehicle loss insurance, third-party liability insurance, vehicle stop loss insurance and scratch insurance. Among them, traffic insurance is a must-buy insurance according to national law. Traffic enforcement insurance Traffic enforcement insurance (full name compulsory motor vehicle traffic accident liability insurance) is the first compulsory insurance system in China prescribed by national law.

5. There are mainly the following types of automobile insurance: motor vehicle insurance. Motor vehicle insurance is a kind of insurance for automobiles, trams, battery vehicles, motorcycles, tractors and other motor vehicles as insurance targets.

1. Motor vehicle insurance generally includes traffic insurance and commercial insurance. Commercial insurance includes two parts: basic insurance and additional insurance. BaseThis insurance is divided into vehicle loss insurance and third-party liability insurance, whole-vehicle theft and robbery insurance (theft and robbery insurance), vehicle personnel liability insurance (driver liability insurance and passenger liability insurance).

2. Generally speaking, the fully insurance of cars recognized by everyone refers to: traffic enforcement insurance + vehicle damage insurance + third-party liability insurance + non-deductible + vehicle personnel insurance, etc. If there are conditions, theft and robbery insurance, glass insurance, body scratch insurance, spontaneous combustion insurance, etc. can also be added.

3. Car damage insurance: Car damage insurance is the most basic car insurance. It can compensate for losses caused by vehicle collisions, scratches, natural disasters, etc. However, it should be noted that the absolute deductible voluntarily cannot exceed 20% of the insurance amount.

4. What are the types of car insurance? Auto insurance is mainly divided into two categories: traffic insurance and commercial insurance. Among them, traffic insurance must be insured, while commercial insurance can be insured according to your own needs.

5. Traffic enforcement insurance is a compulsory insurance that must be purchased by motor vehicles. The insurance company shall compensate for the personal injury and property loss caused by the insured motor vehicle to the victim (excluding the personnel of the vehicle) in a road traffic accident within the liability limit. Simply put, traffic enforcement insurance is "mandatory three-liability insurance".

Car damage insurance: Car damage insurance is the most basic car insurance. It can compensate for losses caused by vehicle collisions, scratches, natural disasters, etc. However, it should be noted that the absolute deductible voluntarily cannot exceed 20% of the insurance amount.

The insurance that cars generally need to buy mainly includes traffic insurance and commercial insurance.Traffic insurance is a mandatory vehicle insurance, and all vehicles must be purchased. It is mainly used to compensate for the losses of the victims in traffic accidents, including casualties and property losses.

The four types of insurance that vehicles must buy are as follows: Traffic enforcement insurance: Traffic enforcement insurance is a compulsory insurance purchased by the state. It is a mandatory liability insurance that the insurance company compensates for the personal injury and property losses caused by the insured motor vehicle in a road traffic accident within the liability limit, but does not include the personnel of the vehicle and The insured.

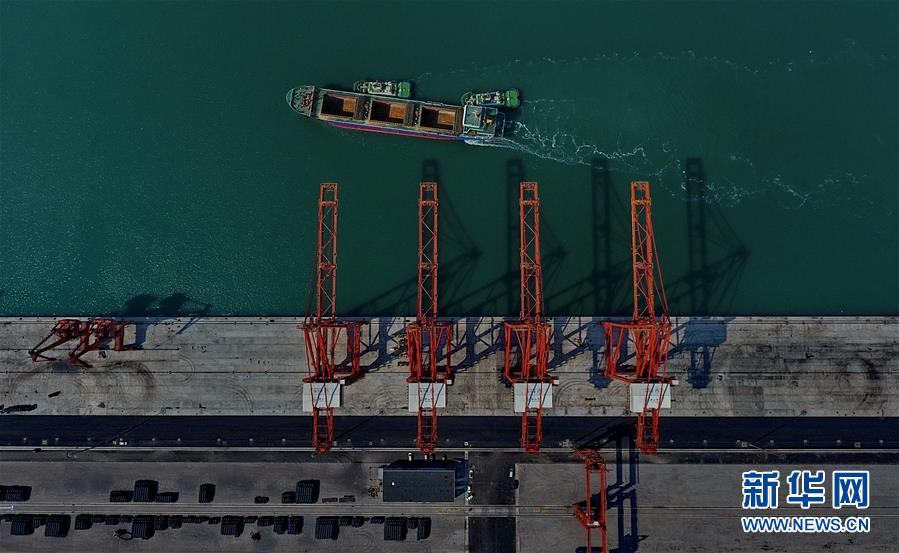

Global trade data for currency hedging-APP, download it now, new users will receive a novice gift pack.

1. Automobile insurance refers to a kind of commercial insurance that is liable for personal injury or property loss caused by natural disasters or accidents of motor vehicles.

2. Hello, vehicle insurance, that is, motor vehicle insurance, abbreviated as car insurance, also known as car insurance. It refers to a kind of commercial insurance that is liable for personal injury or property loss caused by natural disasters or accidents of motor vehicles.

3. Automobile insurance, abbreviated as car insurance, refers to the protection of casualties and property losses caused by natural disasters or accidents of motor vehicles. Car insurance is a kind of property insurance, which arises and develops with the emergence and popularization of automobiles.

1. Car insurance mainly includes: traffic enforcement insurance, third-party liability insurance, vehicle loss insurance, vehicle personnel liability insurance, theft and robbery insurance, separate glass breakage insurance, and traffic enforcement insurance is a must-buy.

2. The types of automobile insurance mainly include the following types: traffic enforcement insurance, vehicle loss insurance, third-party liability insurance, whole vehicle theft and robbery insurance, separate glass breakage insurance, spontaneous combustion loss insurance, non-deductible special insurance, etc.

3. You can buy three types of car insurance: traffic insurance, three-party insurance and car damage insurance. The following is a specific introduction to car insurance: Traffic enforcement insurance: Traffic enforcement insurance is the insurance that every car owner must buy according to law. When a vehicle has a traffic accident, it can have the most basic insurance claims.

4. Vehicle insurance generally requires traffic insurance, vehicle loss insurance, third-party liability insurance, vehicle stop loss insurance and scratch insurance. Among them, traffic insurance is a must-buy insurance according to national law. Traffic enforcement insurance Traffic enforcement insurance (full name compulsory motor vehicle traffic accident liability insurance) is the first compulsory insurance system in China prescribed by national law.

5. There are mainly the following types of automobile insurance: motor vehicle insurance. Motor vehicle insurance is a kind of insurance for automobiles, trams, battery vehicles, motorcycles, tractors and other motor vehicles as insurance targets.

1. Motor vehicle insurance generally includes traffic insurance and commercial insurance. Commercial insurance includes two parts: basic insurance and additional insurance. BaseThis insurance is divided into vehicle loss insurance and third-party liability insurance, whole-vehicle theft and robbery insurance (theft and robbery insurance), vehicle personnel liability insurance (driver liability insurance and passenger liability insurance).

2. Generally speaking, the fully insurance of cars recognized by everyone refers to: traffic enforcement insurance + vehicle damage insurance + third-party liability insurance + non-deductible + vehicle personnel insurance, etc. If there are conditions, theft and robbery insurance, glass insurance, body scratch insurance, spontaneous combustion insurance, etc. can also be added.

3. Car damage insurance: Car damage insurance is the most basic car insurance. It can compensate for losses caused by vehicle collisions, scratches, natural disasters, etc. However, it should be noted that the absolute deductible voluntarily cannot exceed 20% of the insurance amount.

4. What are the types of car insurance? Auto insurance is mainly divided into two categories: traffic insurance and commercial insurance. Among them, traffic insurance must be insured, while commercial insurance can be insured according to your own needs.

5. Traffic enforcement insurance is a compulsory insurance that must be purchased by motor vehicles. The insurance company shall compensate for the personal injury and property loss caused by the insured motor vehicle to the victim (excluding the personnel of the vehicle) in a road traffic accident within the liability limit. Simply put, traffic enforcement insurance is "mandatory three-liability insurance".

Car damage insurance: Car damage insurance is the most basic car insurance. It can compensate for losses caused by vehicle collisions, scratches, natural disasters, etc. However, it should be noted that the absolute deductible voluntarily cannot exceed 20% of the insurance amount.

The insurance that cars generally need to buy mainly includes traffic insurance and commercial insurance.Traffic insurance is a mandatory vehicle insurance, and all vehicles must be purchased. It is mainly used to compensate for the losses of the victims in traffic accidents, including casualties and property losses.

The four types of insurance that vehicles must buy are as follows: Traffic enforcement insurance: Traffic enforcement insurance is a compulsory insurance purchased by the state. It is a mandatory liability insurance that the insurance company compensates for the personal injury and property losses caused by the insured motor vehicle in a road traffic accident within the liability limit, but does not include the personnel of the vehicle and The insured.

Actionable global trade insights

author: 2024-12-24 02:29Predictive trade data modeling

author: 2024-12-24 02:22How to identify top export opportunities

author: 2024-12-24 01:44Sustainable sourcing via HS code tracking

author: 2024-12-24 00:51Global trade shipping route optimization

author: 2024-12-24 00:29International trade database customization

author: 2024-12-24 03:03Industry-specific import regulation data

author: 2024-12-24 02:04Customs broker performance analysis

author: 2024-12-24 01:16HS code mapping to non-tariff measures

author: 2024-12-24 01:06Trade data-driven inventory optimization

author: 2024-12-24 00:42 HS code integration with digital customs forms

HS code integration with digital customs forms

496.41MB

Check Asia trade corridors HS code mapping

Asia trade corridors HS code mapping

498.63MB

Check Analytical tools for trade diversification

Analytical tools for trade diversification

813.97MB

Check supply chain transparency

supply chain transparency

915.92MB

Check Shipping lane performance metrics

Shipping lane performance metrics

564.33MB

Check Free zone HS code compliance

Free zone HS code compliance

573.96MB

Check Global import export data subscription

Global import export data subscription

793.35MB

Check Automated trade documentation tools

Automated trade documentation tools

253.56MB

Check How to align trade data with ESG goals

How to align trade data with ESG goals

832.91MB

Check HS code-based KPI reporting for trade teams

HS code-based KPI reporting for trade teams

831.11MB

Check How to reduce customs compliance risk

How to reduce customs compliance risk

298.92MB

Check HS code-driven freight route adjustments

HS code-driven freight route adjustments

485.93MB

Check HS code electrical machinery data

HS code electrical machinery data

278.97MB

Check GCC HS code-based tariff systems

GCC HS code-based tariff systems

736.25MB

Check Global trade metadata enrichment

Global trade metadata enrichment

612.85MB

Check Trade data for market entry strategies

Trade data for market entry strategies

232.75MB

Check Pharmaceutical imports by HS code

Pharmaceutical imports by HS code

359.36MB

Check Trade data-driven cost modeling

Trade data-driven cost modeling

263.62MB

Check International trade KPI tracking

International trade KPI tracking

335.91MB

Check How to access historical shipment records

How to access historical shipment records

242.37MB

Check Import export software solutions

Import export software solutions

945.74MB

Check Global tender participation by HS code

Global tender participation by HS code

649.59MB

Check HS code tagging in tariff databases

HS code tagging in tariff databases

938.91MB

Check How to analyze customs transaction records

How to analyze customs transaction records

984.94MB

Check Supply chain data

Supply chain data

551.57MB

Check How to ensure trade compliance audits

How to ensure trade compliance audits

344.96MB

Check trade data solutions

trade data solutions

356.16MB

Check How to track global shipments

How to track global shipments

267.19MB

Check Global trade agreement analysis

Global trade agreement analysis

349.67MB

Check HS code compliance in African unions

HS code compliance in African unions

452.13MB

Check Global sourcing risk by HS code

Global sourcing risk by HS code

918.93MB

Check shipment data access

shipment data access

129.18MB

Check Top trade data trends reports

Top trade data trends reports

871.59MB

Check Dairy powder HS code references

Dairy powder HS code references

241.75MB

Check Customs data verification services

Customs data verification services

926.54MB

Check Global trade scenario planning

Global trade scenario planning

186.33MB

Check

Scan to install

Global trade data for currency hedging to discover more

Netizen comments More

2273 Forestry products HS code insights

2024-12-24 02:32 recommend

251 HS code-focused compliance audits

2024-12-24 01:22 recommend

1989 HS code-based market share analysis

2024-12-24 01:20 recommend

586 Meat and poultry HS code references

2024-12-24 00:38 recommend

360 On-demand trade data queries

2024-12-24 00:29 recommend